Top South Florida real estate strategies 2024 with Kathleen Tamburino: A recent Redfin report throws the spotlight on Florida’s condo market, revealing some interesting shifts that are reshaping the landscape for owners and buyers alike. Data from real estate brokerage Redfin shows a whopping 28.2% jump in the number of condos for sale in January, which is a stark contrast to the 11.1% increase nationwide. The culprits? Soaring insurance and homeowner association (HOA) fees. Because of rising Association fees and increasingly-common special assessments, condos are taking much longer to sell. While Florida’s median sales prices for condos nudged up by 2.4%, thats less than the 8.4% growth for condos nationwide. Median prices for condos fell 6.5% in Jacksonville, by 4.8% in Orlando, 2.5% in Miami and by 1% in Tampa. See additional information on Kathleen Tamburino.

Renovating increases the house value says Kathleen Tamburino : Aspiring renovators sometimes get so focused on getting the desired ‘visual result’ with fabulous kitchens, decor and so on, that they risk running out of money for works to the building envelope — sometimes referred to as the ‘unseens’. If you don’t prioritise key works, such as leaking roofs, timber decay and structural movement, it won’t be long before deterioration of the fabric takes hold, at which point it might be a matter of some regret that so much of the budget was showered on top-of-the-range designer appliances.

Limit your house payment to no more than 25% of your monthly take-home pay. This payment includes principal, interest, property taxes, homeowner’s insurance and, if your down payment is lower than 20%, private mortgage insurance (PMI). Plus, don’t forget to consider homeowner’s association (HOA) fees when preparing your budget. Save at least a 10–20% down payment. A 20% or more down payment helps you avoid PMI—an extra fee added to your mortgage to protect your lender (not you) in case you don’t make payments. Anything less than 10% will drown you in extra interest and fees. Saving a big down payment like this is possible! If you stay patient and motivated, you can save for a five-figure down payment by this time next year.

High quality Florida real estate market opportunities in 2024 by Kathleen Tamburino: Create A List Of Amenities – When shopping for a home, list the Top 10 features (fireplace, fenced-in yard, new appliances, etc.) that are most important to you. Establishing this criteria early will save time shopping for inappropriate homes and keep you from buying a home on a whim. Your top reason for buying a home should be the value you are getting. That being said, some of your top 10 amenities could be sacrificed if an incredible value becomes available.

Have Financial Goals: If you want to accomplish financial goals, you need to figure out what goals are important to you first. Having a clear goal can keep you motivated and help you come up with a plan to reach that goal even faster. Now, don’t think that you need to set outrageous goals. If this is your first time thinking about personal financial goals, start off small and work your way up from there. I’d suggest coming up with a few different goals in each of these categories: What you want to achieve in the next 3-months, In the next year, In the next five years. This way you’ll have some short-term goals to look forward too, and some long-term goals to work towards as well. Your short-term goals may even be small stepping stones towards your bigger goals. So, remember to set long-term and short-term goals, and keep track of them too! Write them down somewhere and set a day each month to track your progress. Find more details on Kathleen Tamburino.

Kathleen Tamburino South Florida top real estate market opportunities in 2024: Solid wood floors are extremely strong and durable because of the large amounts of wood that sits above the tongue that maybe sand many times. The recommended fitting for these types of boards are a fix or permanent fix to the sub floor. This would mean either fully gluing the board to your sub floor whether it is concrete or sheet material timber or secret nailing at an angle through the tongues to fix to the sub floor.

One of the largest reasons some buyers walk away from a home purchase feeling remorseful is because they don’t consider everything about purchasing real estate before they jump into it. There are common buyer mistakes we address with all of our buyers upfront so they have a highly successful transaction. One thing that many folks don’t want to do is put in the upfront work, studying, and preparation that goes into buying a house. You need to prioritize your needs, and your wants – and if you have a partner you need to communicate together on everything. Maybe one person is ready to buy, and the other isn’t ready just yet.

Here are a few real estate tricks: You probably don’t have the same skill set as Joanna and Chip Gaines, but you might still wind up with a fixer-upper thanks to those inventory constraints. And that’s totally okay. What I’ve learned from buying real estate is that you’ll typically never be content with the upgrades previous owners or developers make, even if they were super expensive and high quality. So why pay extra for it? There’s a good chance you’ll want to make the home yours, with special touches and changes that distance yourself from the previous owner. Don’t be afraid to go down that road, but also know the difference between superficial blemishes and design challenges, and even worse, major problems. Especially this year, watch out for money pits that sellers can finally unload because real estate is just so very hot. Those properties that could never sell may finally find a buyer, and you might not want that buyer to be you.

Any Realtor will tell you that homes that do not get shown have a tough time getting sold. The last thing you want to do is make it difficult for your agent to get their clients into your home. If you require buyers to make appointments during a restrictive timeframe or way in advance, they will more than likely go to other places that are easy to get into or even cross your home off the list.

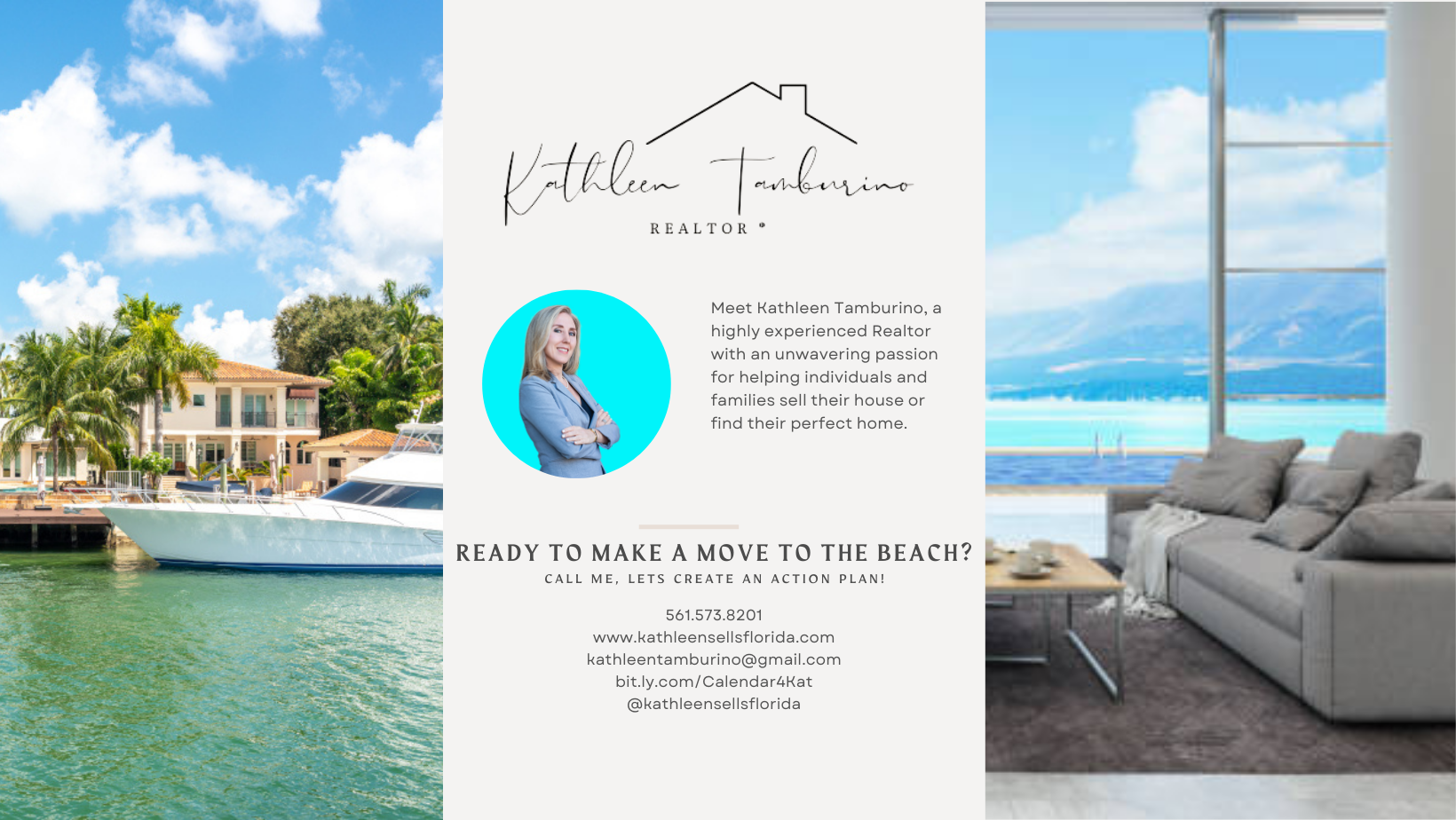

Buying or selling a home in Florida is a legal transaction that requires expertise, understanding, and a desire to do right for your client. Kathleen brings her home buying and selling clients a unique experience and understanding of real estate. Once you become Kathleen’s client, she will think about you 24/7 until she meets all your real estate needs. As a former Business Education Teacher in NYC, she offers a dedication and tenacity you will not get with any other real estate agent.

Kathleen is focused on providing you with the best results and service in the industry. She listens carefully to understand your real estate goals and works hard to create solutions that make sense for you. Whether you are new to the market or an experienced investor, Kathleen has the expertise and resources to help you achieve your real estate goals. She understands that buying or selling a home can be a stressful and overwhelming process, which is why she makes it her top priority to guide her clients through every step of the transaction with patience and professionalism.

As is often said, real estate is about location. Kathleen has extensive knowledge of the Palm Beach County, FL area and can help you find the right home for you or the right buyer for your home.